Motor Insurance: Your Motor Insurance.

is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley

is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley

الأسئلة الشائعة

How does medical insurance work, and what are its key components?

Medical insurance is a financial arrangement designed to help individuals and families manage the cost of healthcare. By paying regular premiums to an insurance company, policyholders gain access to a wide range of medical services, from routine doctor visits to major surgeries, often at a reduced cost. The system works by spreading the risk of high medical expenses across a large pool of insured individuals, allowing everyone to benefit from collective financial protection.

Travel Insurance: Your Health, Our Priority.

t is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look

t is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look

الأسئلة الشائعة

How does medical insurance work, and what are its key components?

Medical insurance is a financial arrangement designed to help individuals and families manage the cost of healthcare. By paying regular premiums to an insurance company, policyholders gain access to a wide range of medical services, from routine doctor visits to major surgeries, often at a reduced cost. The system works by spreading the risk of high medical expenses across a large pool of insured individuals, allowing everyone to benefit from collective financial protection.

Medical Insurance: Your Health, Our Priority.

Medical insurance is a type of coverage that helps individuals and families manage the costs of healthcare. By paying premiums, policyholders gain access to a variety of medical services, treatments, and preventive care, depending on the specifics of their insurance plan.

Medical insurance is a vital tool for managing healthcare expenses and ensuring access to necessary medical services. By understanding the different aspects of medical insurance, individuals can make informed decisions that best meet their health and financial needs.

الأسئلة الشائعة

كيف يعمل التأمين الطبي وما هي مكوناته الأساسية؟

التأمين الطبي هو نظام مالي مصمم لمساعدة الأفراد والأسر على إدارة تكاليف الرعاية الصحية. من خلال دفع أقساط منتظمة لشركة تأمين، يحصل حاملو الوثائق على مجموعة واسعة من الخدمات الطبية، بدءًا من زيارات الطبيب الروتينية ووصولًا إلى العمليات الجراحية الكبرى، غالبًا بتكلفة منخفضة. يعمل هذا النظام على توزيع مخاطر النفقات الطبية الباهظة على مجموعة كبيرة من الأفراد المؤمَّن عليهم، مما يتيح للجميع الاستفادة من الحماية المالية الجماعية.

ما هي مزايا وعيوب التأمين الطبي المحتملة؟

من أهم فوائد التأمين الطبي حماية الأفراد والأسر من تكاليف الرعاية الصحية الباهظة. فحالة طبية طارئة واحدة، كالجراحة أو الإقامة في المستشفى، قد تُكلف آلاف الدولارات. يُساعد التأمين على تغطية جزء كبير من هذه التكاليف، مما يُخفف العبء المالي على المؤمَّن عليه. فبدون تغطية، قد تُؤدي الفواتير الطبية إلى الديون أو الإفلاس، خاصةً في حالات الأمراض الخطيرة.

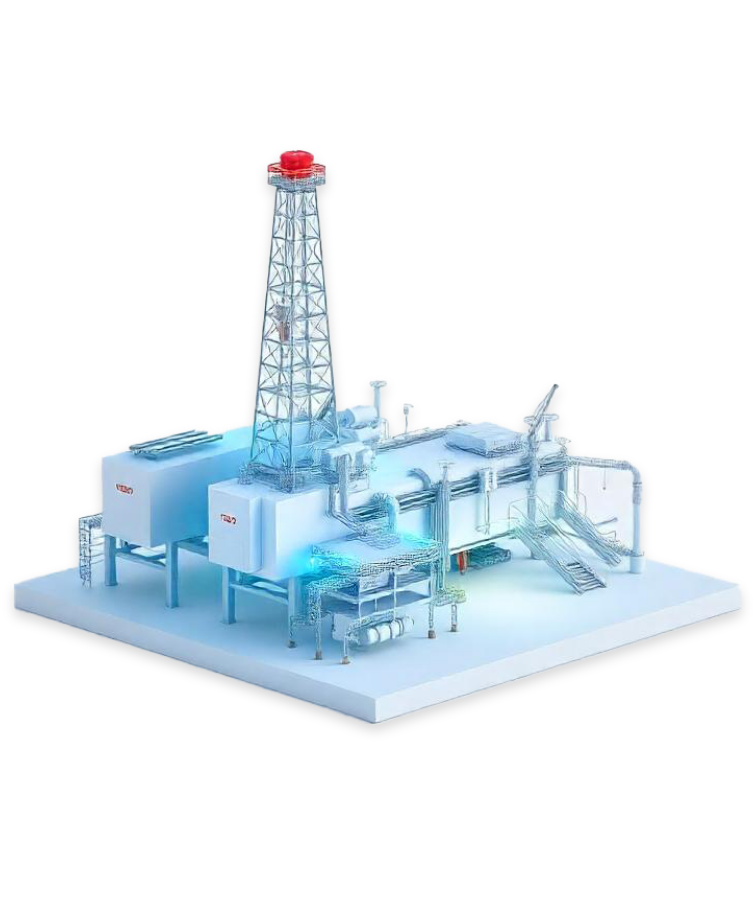

General Insurance: Your Motor Insurance.

t is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look

t is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look

الأسئلة الشائعة

How does medical insurance work, and what are its key components?

Medical insurance is a financial arrangement designed to help individuals and families manage the cost of healthcare. By paying regular premiums to an insurance company, policyholders gain access to a wide range of medical services, from routine doctor visits to major surgeries, often at a reduced cost. The system works by spreading the risk of high medical expenses across a large pool of insured individuals, allowing everyone to benefit from collective financial protection.

Home & Bot Insurance: Your Motor Insurance.

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using

الأسئلة الشائعة

How does medical insurance work, and what are its key components?

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look like readable English. Many desktop publishing

Group Life Insurance Details

Medical insurance is a type of coverage that helps individuals and families manage the costs of healthcare. By paying premiums, policyholders gain access to a variety of medical services, treatments, and preventive care, depending on the specifics of their insurance plan.

Medical insurance is a vital tool for managing healthcare expenses and ensuring access to necessary medical services. By understanding the different aspects of medical insurance, individuals can make informed decisions that best meet their health and financial needs.

الأسئلة الشائعة

How does medical insurance work, and what are its key components?

Medical insurance is a financial system designed to help individuals and families manage healthcare costs. By paying regular premiums to an insurance company, policyholders receive coverage for a wide range of medical services, from routine doctor visits to major surgeries, often at a low cost. This system spreads the risk of catastrophic medical expenses across a large group of insured individuals, allowing everyone to benefit from collective financial protection.